Introduction

Have you ever wondered what it truly takes to develop a powerful personal finance app like PocketSmith? In today’s fast-paced world, managing personal finances efficiently has become more important than ever. People want intuitive tools that help them track spending, plan budgets, and forecast their financial future effortlessly. However, building such an app is not just about creating a pretty interface; it demands a deep understanding of finance, technology, security, and user experience. Whether you’re a startup founder or an established business aiming to enter the fintech space, knowing the real cost and complexities involved is crucial for making informed decisions.

At True Value Infosoft (best AI developemnt company), we specialize in developing cutting-edge personal finance applications tailored to meet the unique needs of users. With years of experience in fintech software development, our team combines innovative design with robust technology to create secure, scalable, and user-friendly apps. We understand that every feature, integration, and security layer adds to the development cost and timeline.

Understanding PocketSmith and Its Market

PocketSmith is a popular personal finance and budgeting app that distinguishes itself through detailed forecasting and calendar-based money management. It allows users to track their income and expenses, categorize spending, and project future financial scenarios, helping them stay ahead of bills, expenses, and savings goals.

The app's success lies in its user-centric approach, combining powerful analytics with a clean, intuitive interface. PocketSmith supports multi-currency accounts, bank feeds, and offers both web and mobile platforms, making it a comprehensive tool for users who want full control over their financial lives.

Creating a similar app is not just about replicating these features but understanding the needs of your target audience, the regulatory requirements for financial data security, and the latest technology trends to build a reliable, scalable, and user-friendly product.

Key Features of a Personal Finance App Like PocketSmith

Before estimating costs, it's essential to outline the features that make a personal finance app valuable. The more complex and numerous the features, the higher the development cost.

1. User Registration and Profile Management

A seamless sign-up/sign-in process using email, phone number, or social media accounts is vital. Features include profile customization and user preferences.

2. Account Aggregation and Bank Integration

One of the most critical features is integrating users' bank accounts, credit cards, and other financial institutions for automatic transaction imports. This requires secure API connections compliant with financial regulations such as PSD2 in Europe or Open Banking standards.

3. Expense and Income Tracking

Users should be able to manually input or automatically track their income and expenses. Categorization is essential for budgeting and reporting.

4. Budget Creation and Management

Allow users to create monthly or custom budgets, set spending limits per category, and receive notifications when nearing or exceeding budgets.

5. Financial Calendar & Forecasting

Similar to PocketSmith’s core feature, a calendar-based money management system that forecasts future balances based on scheduled income and expenses.

6. Reporting and Analytics

Visual reports like pie charts, bar graphs, and trend lines that provide insights into spending habits, income sources, and net worth.

7. Multi-currency Support

For users with accounts in different currencies, the app should support real-time exchange rates and conversions.

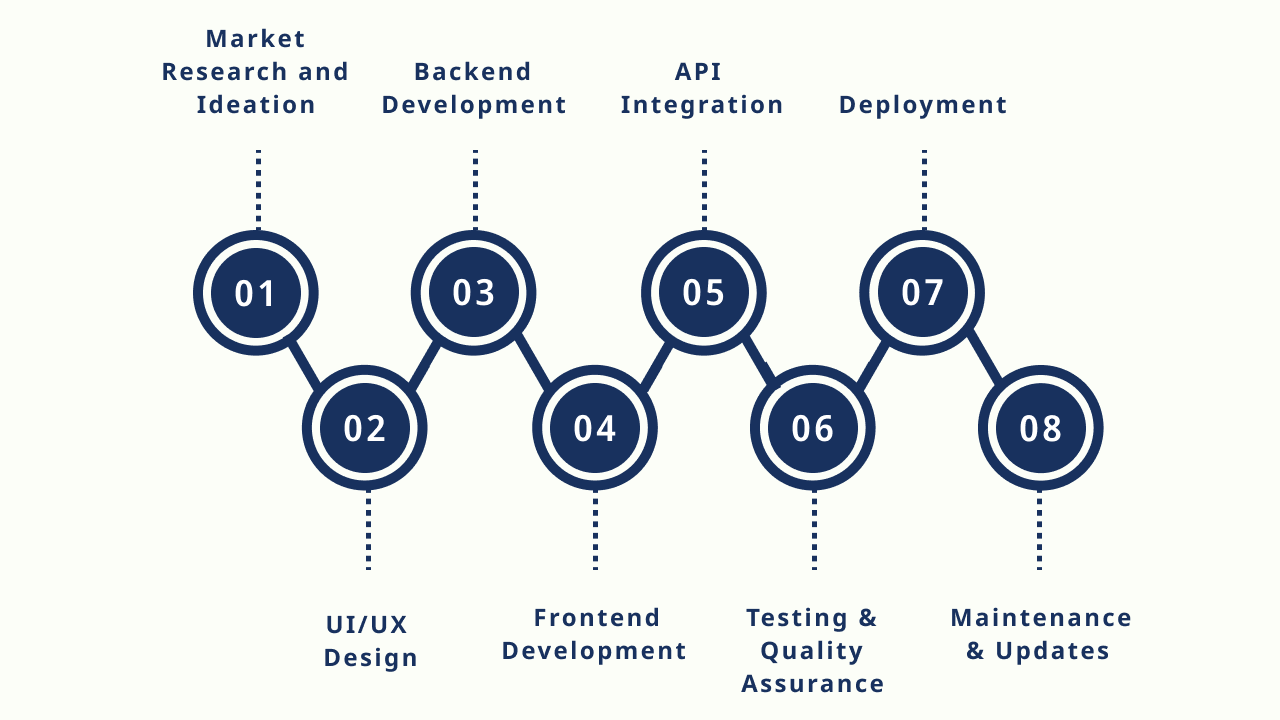

Stages of Development and Associated Costs

Developing an app like PocketSmith involves several phases, each contributing to the overall cost.

1. Market Research and Ideation

Before any coding happens, understanding the target market, competitors, and user needs is crucial. This phase includes brainstorming features, identifying unique selling points, and assessing risks.

- Cost Range: $3,000 - $8,000

- Tasks: Competitor analysis, customer surveys, feature prioritization, technology feasibility.

2. UI/UX Design

Personal finance apps require a clean, intuitive interface that users trust and enjoy using. Designing the user experience and interface involves wireframing, prototyping, and finalizing the look and feel for both mobile and web platforms.

- Cost Range: $8,000 - $25,000

- Tasks: Wireframes, user journey maps, UI mockups, interactive prototypes.

3. Backend Development

This is the backbone of the app, handling data storage, user management, API integrations, business logic, and security.

- Cost Range: $20,000 - $60,000

- Tasks: Server-side logic, database design, payment gateway integration, bank APIs, security protocols.

4. Frontend Development

Building the actual interface on mobile (iOS, Android) and/or web platforms. This includes making the app responsive, interactive, and compatible with different devices.

- Cost Range: $15,000 - $50,000

- Tasks: Mobile app coding, responsive web development, UI animations.

5. API Integration

Integrating with banks and financial institutions requires working with third-party APIs or financial data aggregators like Plaid, Yodlee, or TrueLayer.

- Cost Range: $10,000 - $30,000

- Tasks: API setup, testing, security compliance.

6. Testing & Quality Assurance

Ensuring the app is bug-free, secure, and user-friendly. This phase involves manual and automated testing across devices and platforms.

- Cost Range: $8,000 - $20,000

- Tasks: Functional testing, security testing, performance testing, usability testing.

7. Deployment

Launching the app on app stores and web servers. It includes compliance with Apple’s and Google’s guidelines.

- Cost Range: $2,000 - $5,000

- Tasks: App store submission, server deployment, DNS configuration.

8. Maintenance & Updates

Ongoing updates to fix bugs, add new features, and keep up with OS and security changes.

- Cost Range: 15-20% of initial development cost annually

Technology Stack and Its Impact on Cost

The technology stack you choose significantly influences development time and cost. Some popular tech choices include:

- Frontend: React Native (cross-platform), Swift (iOS), Kotlin (Android), Angular or React (web)

- Backend: Node.js, Python (Django or Flask), Ruby on Rails, Java Spring Boot

- Database: PostgreSQL, MySQL, MongoDB

- API Integration: Plaid, Yodlee, Open Banking APIs

- Cloud Infrastructure: AWS, Microsoft Azure, Google Cloud Platform

- Security: OAuth 2.0, JWT, SSL encryption

Choosing a cross-platform framework like React Native can reduce costs by allowing one codebase for iOS and Android, but may compromise on some native performance. Native development offers better optimization but increases costs.

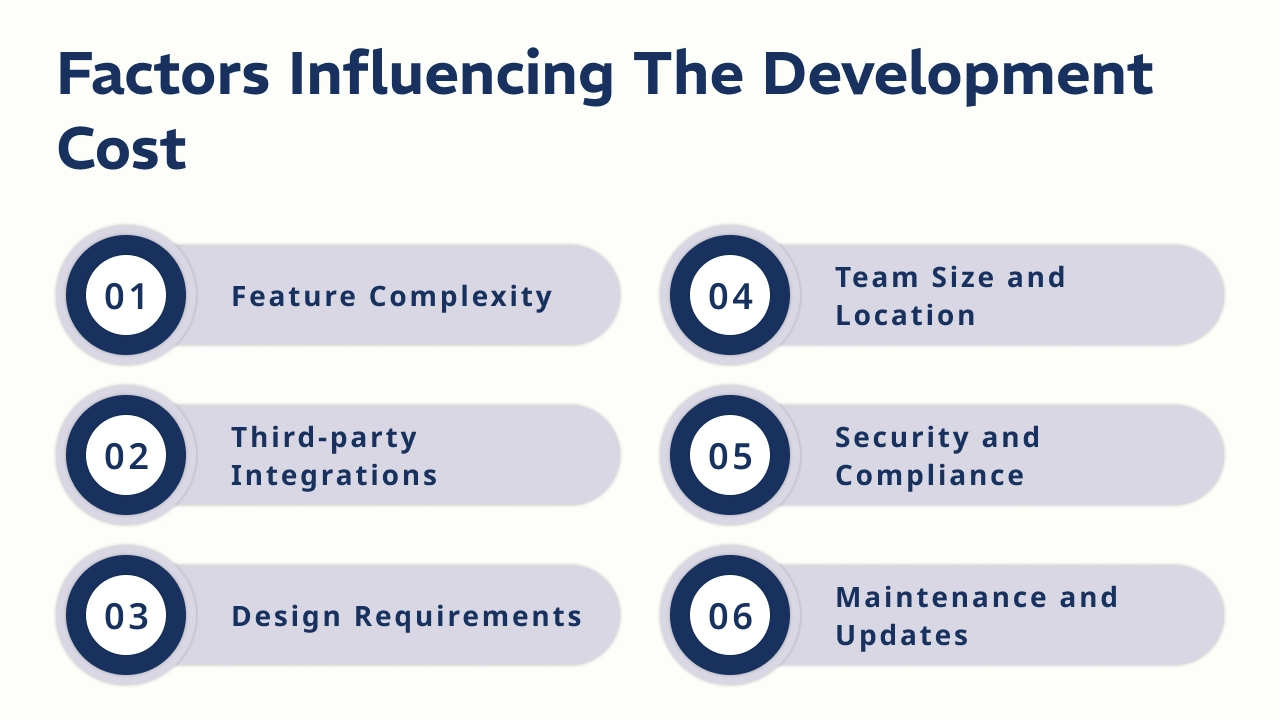

Factors Influencing the Development Cost

1. Feature Complexity

More features, especially advanced ones like predictive analytics and AI-driven insights, require more development time and expertise.

2. Third-party Integrations

Securely integrating multiple bank APIs and financial services can be costly due to licensing and technical challenges.

3. Design Requirements

Highly customized, unique designs with animations and interactions increase design and development time.

4. Team Size and Location

Hiring a full in-house team is more expensive than outsourcing or using freelancers. Development rates vary globally, with North America and Western Europe being the most expensive, while Eastern Europe, India, and Southeast Asia offer cost advantages.

5. Security and Compliance

Finance apps must adhere to strict regulatory standards, increasing development complexity and cost.

6. Maintenance and Updates

Continuous updates to support new devices, regulations, and user requests require ongoing investment.

Estimated Cost Breakdown

Combining all phases and factors, here is a rough cost estimate for building a personal finance app like PocketSmith:

- Basic Version with Core Features: $50,000 - $80,000

- Mid-Level Version with Additional Integrations and Custom Design: $80,000 - $150,000

- Full-Featured, Scalable Version with AI, Advanced Analytics, Multi-Currency Support: $150,000 - $300,000+

These estimates vary based on location, team expertise, and specific business requirements.

Building the Right Development Team

Developing such an app demands a well-rounded team of experts:

- Project Manager: Oversees the project timeline, budget, and communication.

- Business Analyst: Gathers requirements and translates them into technical specifications.

- UI/UX Designers: Create the user interface and experience.

- Backend Developers: Build server-side logic, database management.

- Frontend Developers: Build the user-facing app interfaces.

- QA Engineers: Conduct thorough testing.

- Security Experts: Ensure data safety and compliance.

- DevOps Engineers: Manage deployment and cloud infrastructure.

Each role adds to the overall cost but is essential for a robust product.

Challenges in Developing a Personal Finance App

1. Bank API Limitations

Bank APIs can be inconsistent, limiting data availability or requiring manual intervention.

2. Security Risks

Handling sensitive financial data makes the app a prime target for cyberattacks, requiring top-notch security.

3. User Adoption

Convincing users to trust and use the app regularly involves careful marketing and a superior user experience.

4. Regulatory Compliance

Financial apps must comply with local and international regulations, which can be complex and costly.

5. Scalability

Ensuring the app performs well as the user base grows requires robust architecture.

Monetization Strategies to Consider

To recoup development costs and generate profit, consider:

- Freemium Model: Basic features free, premium features via subscription.

- In-App Purchases: Additional tools or data reports.

- Advertisements: Carefully placed, non-intrusive ads.

- Affiliate Marketing: Partnering with financial institutions or services.

- Data Insights: Offering anonymized market insights (with user consent).

Why Partner with True Value Infosoft for Your Finance App Development

True Value Infosoft Pvt. Ltd., based in Jaipur, India, has over a decade of experience in delivering custom software solutions including financial applications. They specialize in building secure, scalable, and feature-rich mobile and web apps tailored to client needs.

- Expertise: Experienced in fintech app development, compliance, and security.

- Customization: Tailored solutions fit for startups to enterprises.

- Cost-effective: Competitive pricing without compromising quality.

- End-to-End Services: From concept to deployment and maintenance.

- Client Satisfaction: A portfolio of successful fintech projects and positive client testimonials.

Future Trends in Personal Finance Apps

1. Artificial Intelligence and Machine Learning

Apps will increasingly use AI to provide personalized financial advice and detect fraud.

2. Blockchain Integration

Enhancing security and transparency in transactions and data management.

3. Voice-activated Finance Management

Users will manage finances via voice commands with smart assistants.

4. Open Banking Ecosystems

More seamless integrations and data sharing between financial institutions and apps.

5. Enhanced Data Visualization

More intuitive and interactive ways to understand financial data.

Conclusion

In conclusion, developing a personal finance app like PocketSmith is a multifaceted endeavor that demands careful planning, significant investment, and expert execution. The overall cost depends on numerous factors such as the complexity of features, technology stack, security requirements, third-party integrations, and the development team’s expertise. From core functionalities like expense tracking and budgeting to advanced elements such as bank API integrations and financial forecasting, each feature adds layers of complexity—and cost—to the project.

Choosing the right development partner is crucial to navigating these challenges successfully. True Value Infosoft stands out as a trusted and experienced software development company specializing in fintech and personal finance applications. With a proven track record in delivering secure, scalable, and user-friendly solutions, True Value Infosoft offers end-to-end development services tailored to your unique business needs. Their commitment to quality, innovation, and client satisfaction ensures your app will not only meet market demands but also provide exceptional value to users.

Partnering with True Value Infosoft gives you access to a skilled team that understands the nuances of financial technology, helping you bring your vision to life efficiently and cost-effectively. This partnership is key to building a competitive personal finance app ready to thrive in today’s digital economy.

FAQs

The cost to develop a personal finance app like PocketSmith typically ranges between $25,000 to $150,000+, depending on features, platforms, complexity, and development team location.

Major cost-driving features include bank integration, budget tracking, real-time sync, AI-based insights, data security, and multi-device compatibility.

Yes, using cross-platform frameworks like Flutter or React Native can reduce development time and cost by up to 30–40% compared to building separate native apps.

Absolutely. Ongoing expenses include server hosting, maintenance, security updates, bug fixes, and feature upgrades, typically costing 15–25% of the initial development cost per year.

Yes. An MVP with basic budgeting, account linking, and analytics can be built for $20,000–$40,000, allowing you to validate the idea before investing further.